Utah Housing Forecast: 2025

Utah Housing Forecast: 2025

A comprehensive review and forecast of the Salt Lake County residential real estate market, examining current trends and future projections. This analysis explores housing prices, affordability challenges, market dynamics, and economic factors influencing the local housing landscape.

Information taken from a report prepared by James Wood, Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute, David Eccles School of Business at the University of Utah. Commissioned by the Salt Lake Board of Realtors®.

LINK TO INTERACTIVE REPORT HERE

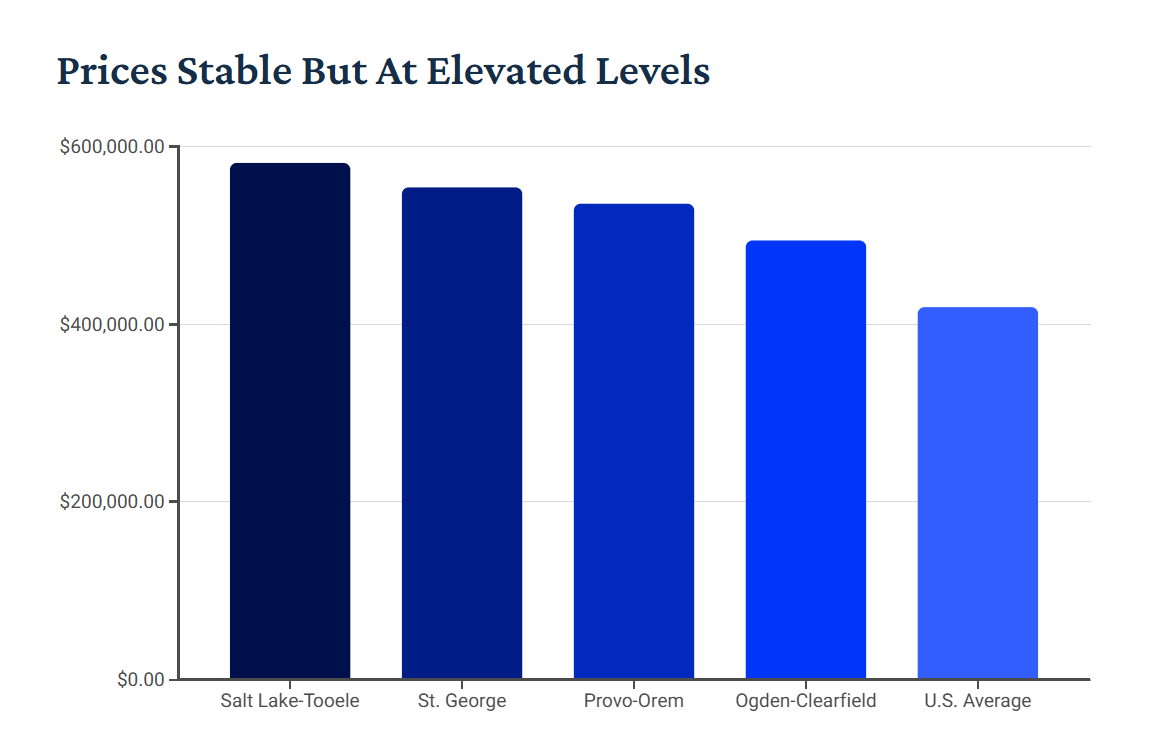

Prices Stable But At Elevated Levels

Housing prices in Utah's metropolitan areas rank among the highest in the country. The Salt Lake-Tooele area ranks 28th highest out of 227 metro areas, with St. George, Provo-Orem, and Ogden-Clearfield following closely at 30th, 31st, and 34th respectively.

While rapid demographic and economic growth from 2010-2022 drove prices up as demand outstripped supply, a price correction is now underway. In the past two years, Salt Lake County's median single-family home price increased just 1% (from $606,000 to $610,000), while condominium prices decreased about 1% (from $430,000 to $425,500).

Affordability Crisis For Homebuyers:

$4,674

Monthly Payment

For median single-family home

$186,960

Income Required

To finance median home

$3,284

Condo Payment

30% less than single-family

$101,000

Median Income

Salt Lake County households

Despite the pause in price increases, mortgage payments remain prohibitively high for many potential buyers. The monthly payment for a median-priced single-family home totals $4,674 (assuming 5% down and 6.63% interest rate), requiring an annual income of $186,960 – far above the county's median household income of $101,000.

Condominiums offer more affordable options, with monthly payments around $3,284, but still require substantial income of $131,360. This affordability gap limits most first-time homebuyers to properties below $500,000 or even $400,000.

Housing Affordability Hurts Sales

The median multiple ratio (median home price divided by median household income) illustrates Utah's affordability challenge. Salt Lake and Washington counties are now classified as "severely unaffordable" with ratios above 5.1, while Weber, Davis, and Utah counties are "seriously unaffordable" with ratios between 4.1 and 5.0.

This declining affordability has dramatically impacted sales. Existing home sales in Salt Lake County have fallen from 19,041 in 2020 to just 12,070 in 2024 – equivalent to 2011 levels when the market was still recovering from the Great Recession.

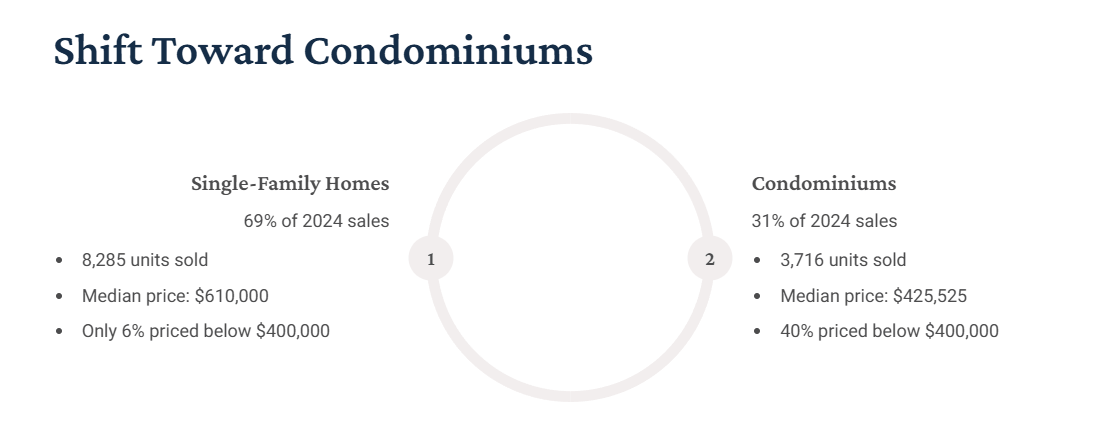

Shift Toward Condominiums

The affordability crisis has caused a significant shift in housing demand from single-family homes to more affordable condominiums. In 2010, condominiums accounted for just 17% of existing home sales (1,765 units). By 2024, their share had grown to nearly 31% (3,716 units).

Condominiums now represent almost one out of every three existing homes sold in Salt Lake County, offering more accessible price points for buyers. Forty percent of condominiums sold were priced below $400,000, compared to only 6% of single-family homes.

Market Indicators Show Easing Pressure

2021: Seller's Market Peak

Median days on market: 6 days

Historically low inventory levels

2024: Market Balancing

Median days on market: 30 days

Listings slightly above 5-year average

25-Year Average

Median days on market: 38 days

Current conditions approaching historical norms

Two important real estate indicators point to easing price pressures. First, the median days on market from listing to contract has increased from just 6 days in 2021 to 30 days in 2024, approaching the 25-year average of 38 days.

Second, active listings in 2024 are slightly higher than the five-year average, indicating sellers are willing to enter the market despite concerns that homeowners with low mortgage rates would be reluctant to sell. This healthy supply of available homes helps relieve upward pressure on prices.

Economic Factors Tempering Demand

Slowing Employment Growth

Utah's job growth has fallen to match national rates (1.7% in 2024), well below its historical 50-year average of 2.83%

Declining Net Migration

Net migration dropped from 35,000 persons two years ago to 26,000 in 2024, reducing housing demand by 3,000-4,000 units

Persistent High Mortgage Rates

Projections show rates remaining between 6-7% through 2026, maintaining affordability challenges

Housing demand is being tempered by several economic factors. Uncharacteristically, Utah's employment growth has slowed to match national rates, reducing the state's typically strong net migration. Job opportunities drive migration, and the forecast for statewide job growth by 2026 is just 14,000 – far below the typical 40,000-50,000 jobs.

Meanwhile, mortgage rate projections from major financial institutions show rates remaining above 6% but below 7% through 2026, providing little relief for affordability concerns.

2025 Market Outlook

Sales Forecast:

Modest increase expected, with 8% growth in condominium sales (to 4,000 units) and 3% growth in single-family sales (to 8,600 units)

Price Projections:

Single-family homes: 2% increase to $620,000

Condominiums: 6% increase to $450,000

Combined increase: 3.3%

Market Conditions

Mortgage rates expected to fluctuate between 6-7%

Increased listings will ease upward price pressure

Affordability challenges will persist

The 2025 outlook for Salt Lake County's housing market shows modest improvement but continued challenges. Demographic and economic growth will be slightly slower, while the lingering effects of the 2020-2022 market excesses will continue to impact affordability. Sales are projected to increase modestly, with condominiums outpacing single-family homes. Price growth will be moderate, with the median single-family home price rising 2% to $620,000 and condominiums increasing 6% to $450,000. However, this forecast assumes mortgage rates remain between 6-7% – any significant movement could substantially alter these projections.

Categories

Recent Posts

Discover Multi-Family Living at 3964 S 565 E, Salt Lake City, UT

Draper, Utah Real Estate: Blair Allen - Your Expert Guide for Buyers, Families & First-Time Buyers!

Experience Sugar House: Blair Allen - Your Expert Realtor for Urban Living & First-Time Buyers in Salt Lake City's Hottest Neighborhood!

Discovering Your Dream Home in Sandy, Utah: Blair Allen - Your Trusted Realtor for Every Buyer, Especially First-Timers!

Your Ultimate Guide to Cottonwood Heights Homes: Blair Allen - The Realtor Buyers & First-Timers Trust

Your Edge in Millcreek & Holladay: Blair Allen - The Top Realtor for Every Home Buyer (Including First-Timers!)

Unlock Your Dream Home in Salt Lake City: Meet Your Wasatch Front Buying Expert

The Secret to Snagging Your Dream Home in Park City: Meet Your Wasatch Back Buying Expert

Utah Market Update: Inventory is BACK!

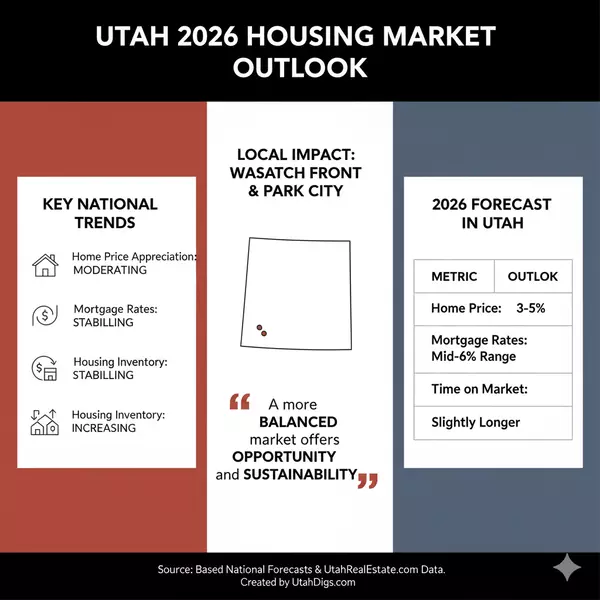

Utah Wasatch Front and Park City 2026 Housing Forecast

Leave a Reply